This is my first follow up on the Deciding When To Sell post. Step one in any simulation analysis is to understand and validate the historical data. If using price history of an index or ETF to evaluate an asset class, one must be aware that some indices include dividends and some don’t. Historic data such as I use here (from finance.yahoo.com), adjusts prices for dividends and stock splits. For purposes of analyzing your investments, I would use historic data that include dividends, but care must be taken to do so correctly.

Here I’m looking at two S&P price histories that mirror the S&P, namely GSPC and SPY. GSPC doesn’t include dividends, but SPY, however, a total return index tracking ETF, does pay dividends. Moreover, Spy pays dividends in cash – it does not automatically reinvest dividends back into the ETF. How should the returns of these two differ? Although GSPC does not track dividends per say, Merton & Modigliani pointed out that market participants should price in the dividend. That is, any stock’s price should decline by the amount of the dividend in the millisecond after the dividend is paid.

Perhaps unfortunately in this sense, price history files don’t show actual prices. Instead, they show prices “adjusted for stock splits” and prices “adjusted for stock splits and dividends.” We could blindly trust that they do this correctly, or to gain understanding we could try to flesh some of this out for ourselves.

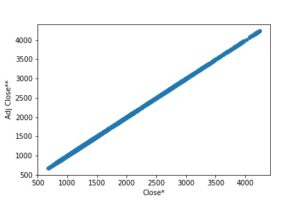

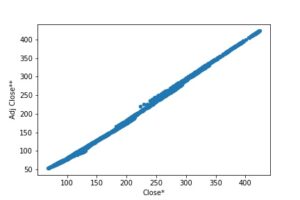

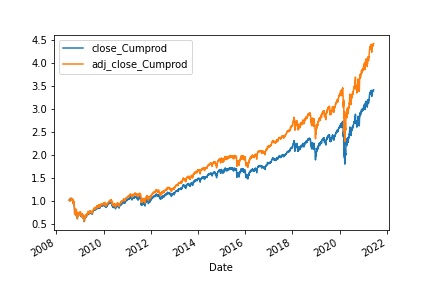

The following two figures plot prices adjusted for stock splits versus prices adjusted for stock splits and dividends.

If adding adjustment for dividends made no difference, like in Fig 1, then this will be a perfect straight line (with slope = 1). Since Fig 2 is not perfectly straight, we are seeing that price adjustments are affected by the dividend.

So, we could stop here and say that whenever we see dividends in the data (at least in so far as with finance.yahoo.com price data) then we know that the adjusted price is accounting for them. And furthermore, we can assume that returns measured as (P2 – P1)/P1, where P is the dividend adjusted price, will accurately reflect the investment return. If so, then we can simply delete the dividend lines in the data, because they are unnecessary for evaluating total returns. An example of a line with a dividend that should be deleted in this case is highlighted below.

| Date | Open | High | Low | Close* | Adj Close** | Volume |

| 19-Mar-21 | 389.88 | 391.57 | 387.15 | 389.48 | 389.48 | 113,624,500 |

| 19-Mar-21 | 1.278 | Dividend | ||||

| 18-Mar-21 | 394.48 | 396.72 | 390.75 | 391.48 | 390.2 | 349,100 |

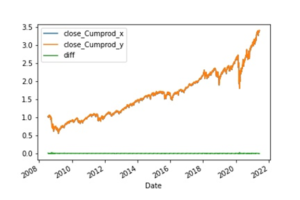

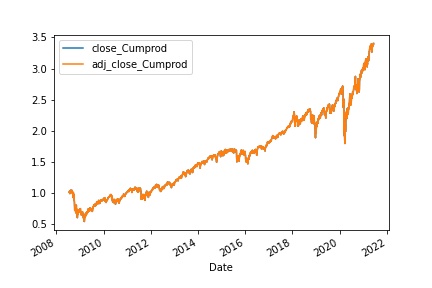

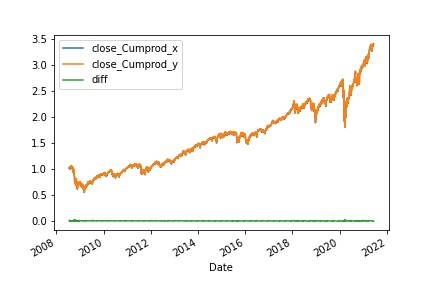

Rather than stop here, I go a step further. I would expect that returns for yahoo’s price history of GSPC prices should be equivalent to returns for SPY prices without adjustments for dividends. In other words, using the Close* column for SPY to calculate returns. This is shown in below figures 3-5

Conclusion.

Know your data. Above I confirm that online price quote histories do truly reflect security returns. To calculate returns correctly, use dividend paying price histories to evaluate potential returns, unless investing in non-total return assets such as many ETFs and derivatives. To simulate reinvesting dividends, use prices adjusted for dividends, but delete dividends given, because the adjusted price accounts for them. Alternatively, to simulate not reinvesting, create a separate identifier for cash from dividends, and use the price that is only adjusted for splits and not dividends when calculating returns.