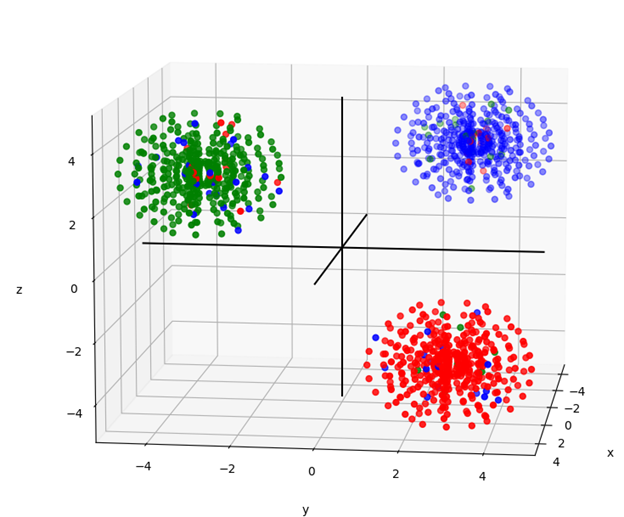

To test the behavior of an algorithm and determine if it works properly, I created a test set with 3 dimensions and 3 classifications from distributions that are defined. In this case they are represented by 3 separate spheres in different quadrants of space. I generated 5% errors into the test set. For example,… Continue reading Random Forest Machine Learning Modeling

Category: Trading

Why is forward PE ratio HIGHER than trailing PE ratio for REITS?

I have reason to wonder why several real estate investment trust (REITs) have forward price-to-earnings ratio (PE) that are HIGHER than their current (aka trailing) PE ratio. This suggests that they are forecasting negative growth in earnings. However, looking at eps forecasts, it doesn’t seem negative. Key thing to understand about REITs is they must… Continue reading Why is forward PE ratio HIGHER than trailing PE ratio for REITS?

When to Sell, Revisited

Part III. Introduction To understand the effects of a strategic rebalancing schedule, I began a study that compares multiple rebalancing strategies. The premise is that people cannot decide when to sell, and systematic methods to buy and sell would take emotions out of the equation and might work better. I choose to start with a… Continue reading When to Sell, Revisited

Data Considerations for Dividends

This is my first follow up on the Deciding When To Sell post. Step one in any simulation analysis is to understand and validate the historical data. If using price history of an index or ETF to evaluate an asset class, one must be aware that some indices include dividends and some don’t. Historic data… Continue reading Data Considerations for Dividends

Deciding when to Sell

For most investors, deciding when to sell is more worrisome than determining when to buy. A systematic method could help by taking away the emotional behavior that gets in the way of selling.

What’s Trading got to do?

It is easier to decide to buy than it is when to sell.